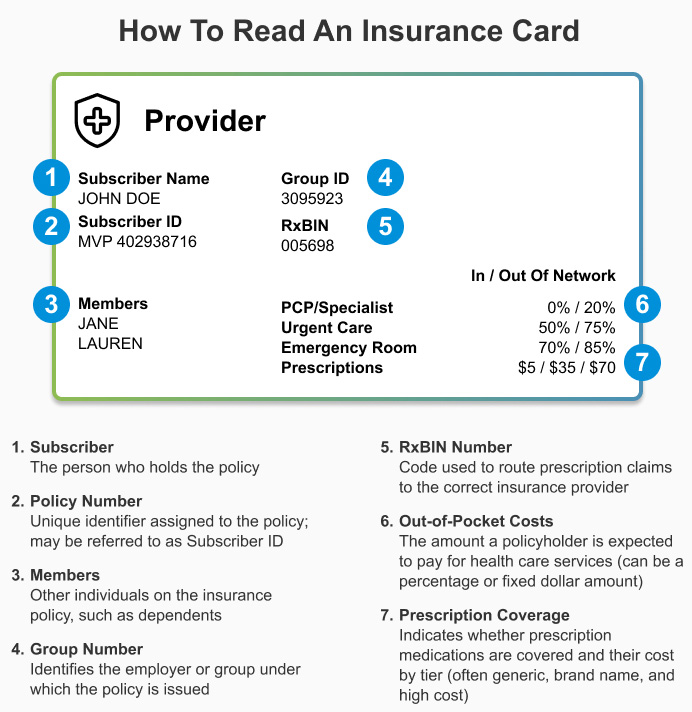

our insurance card is more than just a piece of plastic; it’s a crucial tool that provides essential information about your health coverage. Understanding the details on your insurance card can greatly impact how effectively you manage your health care and finances. Here’s why it’s important to familiarize yourself with the information on your card:

1. Know Your Coverage Details: Your insurance card includes vital information about the type of coverage you have, such as which services are covered and any limitations or exclusions. Understanding these details helps you make informed decisions about your care and avoid unexpected out-of-pocket expenses.

2. Access to Providers:The card typically lists the network of providers and facilities where you can receive covered services. Knowing which providers are in-network can help you save on costs and ensure you receive the full benefits of your plan.

3. Claims and Billing Information:Your card contains essential details like your policy number and group number, which are needed for filing claims and handling billing issues. Accurate information helps prevent delays and errors in processing your claims.

4. Emergency Situations:In case of an emergency, having your insurance card handy ensures that you can quickly provide necessary information to medical professionals and receive timely care without unnecessary complications.

5. Maximize Your Benefits:Understanding your benefits allows you to make the most of your insurance coverage. It helps you take advantage of preventive services, specialist referrals, and any additional perks or programs offered by your plan.

6. Prevent Misunderstandings:Familiarity with the details on your card helps you avoid misunderstandings with healthcare providers about what services are covered and what you might be responsible for paying.

If you have any questions about your insurance card or need assistance understanding your benefits, please contact our office. We’re here to help you navigate your coverage and ensure you receive the care you need.

As we approach the Open Enrollment period, it's essential to remember that changes in your life can impact your health insurance enrollment at any time throughout the year. Here are some key life events that may affect your health insurance coverage:

- Marriage: Adding a spouse to your plan or exploring new coverage options.

- Divorce: Adjusting your policy to reflect changes in your household.

- Childbirth: Adding a new child to your plan or selecting a family plan.

- Employer Change: Evaluating new employer-sponsored health insurance options.

- Loss of Government Benefits: Seeking alternative coverage if you lose eligibility for government programs.

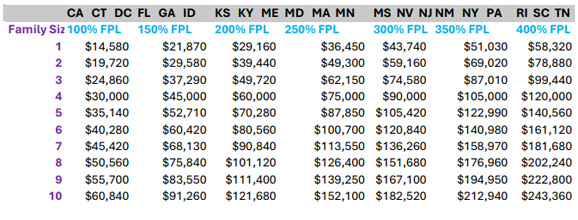

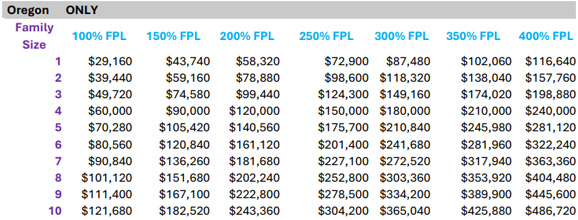

When selecting or managing your Affordable Care Act (ACA) healthcare coverage, understanding the impact of your family size, income guidelines, and zip code is essential. Each of these factors plays a crucial role in determining the type of coverage you are eligible for and the costs associated with it. Here’s why these elements are so important:

1. Family Size:

.- Coverage Options: Your family size affects the number of individuals covered under your plan. The size of your household determines the level of coverage needed and can influence your eligibility for specific plans or subsidies.

- Subsidies and Cost Assistance: Family size is a key factor in calculating eligibility for premium subsidies and cost-sharing reductions. Larger families may qualify for higher subsidies, which can significantly reduce your monthly premiums and out-of-pocket costs.

2. Income Guidelines:

- Eligibility for Subsidies: Your household income relative to the Federal Poverty Level (FPL) determines whether you qualify for financial assistance. Income guidelines help establish if you’re eligible for premium tax credits and cost-sharing reductions, which can lower your overall healthcare expenses.

- Plan Affordability:Understanding income guidelines helps you choose a plan that fits your budget and ensures that you’re not paying more for coverage than necessary. It also helps in predicting your potential out-of-pocket costs based on your financial situation.

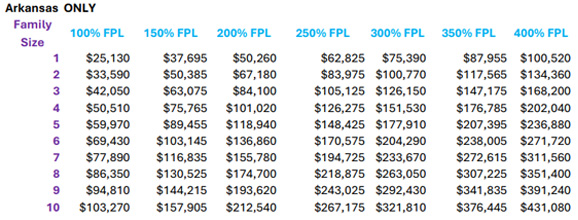

3. Zip Code:

- Plan Availability: Your zip code determines the insurance plans available in your area, as plans can vary by region. Knowing your local options helps you select the best plan suited to your healthcare needs.

- Premium Rates: Premiums can vary significantly based on geographic location. Your zip code affects the cost of coverage, including how much you will pay for monthly premiums and out-of-pocket services. It’s essential to understand these variations to make an informed decision.

4. Overall Impact on Your Coverage:

- Plan Selection:By understanding how your family size, income, and zip code influence your ACA coverage, you can make better choices about the plan that meets your needs and budget.

- Financial Planning:Accurate knowledge of these factors helps you anticipate healthcare costs and plan your budget effectively. It ensures that you’re not surprised by unexpected expenses and that you can make the most of your coverage.

If you have questions about how family size, income guidelines, or your zip code impact your ACA healthcare plan, please don’t hesitate to contact us. We’re here to help you navigate these factors and find the best coverage for you and your family.